By Paul Maplesden Investing in stocks can be a great way to build up your…

Yahoo Finance vs Stock Portfolio Organizer – A Comparison Of Portfolio Trackers

If you are looking for a way to track your portfolio, you may have considered the Yahoo Finance portfolio tracker. If you are serious about trading you will notice that it only allows you to see the total gain for your portfolio and individual trades but that’s about it. Let’s take a look at how Stock Portfolio Organizer offers more features and choices to enable you to track the performance of your portfolio more fully and more adequately.

Below are some of the features of Stock Portfolio Organizer compared to Yahoo Finance.

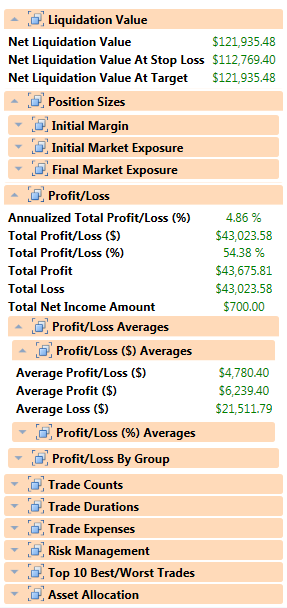

1. Stock Portfolio Organizer’s big list of metrics

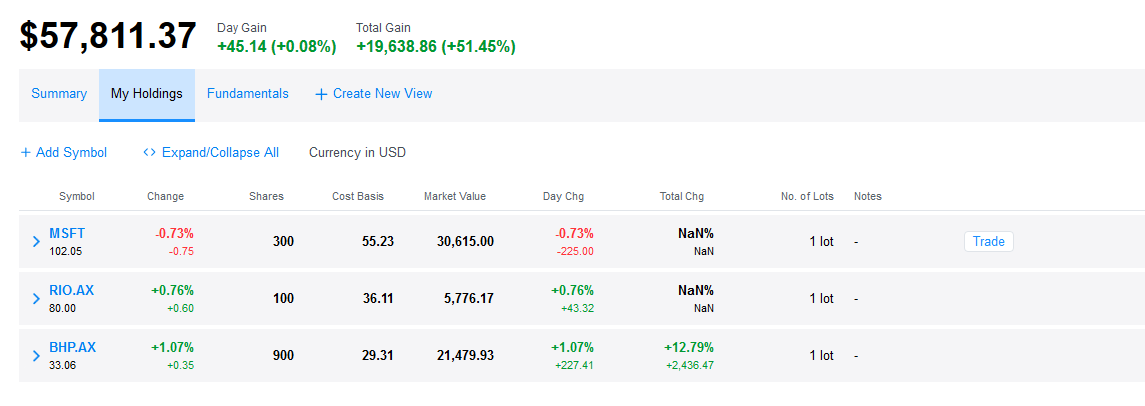

Yahoo Finance only calculates the simple return for your holdings – the difference between what you paid and its value now.

This does not give you a full picture of how much you are making every year. See that +51% gain in the above screenshot? It’s actually an annualized gain of 9.6% over the years. Stock Portfolio Organizer, on the other hand, can calculate the annualized gain and so much more. Stock Portfolio Organizer has a big list of metrics that it calculates ranging from the average number of days a profitable trade is held to various risk management metrics like the average risk to reward ratio.

Yahoo Finance does not have the capacity to allow you to filter your holdings by date. Stock Portfolio Organizer allows you to not only filter by date but by a list of symbols or whether you have specified a stop loss for the trade etc. This along with the large number of metrics allows you to analyse your holdings in ways that are only limited by your imagination.

2. Stock Portfolio Organizer’s ability to track the impact of brokerage and other income like dividends and trust distributions

Yahoo Finance does not allow you to track and include other factors that influence the value of your portfolio. Remember that +51% gain earlier? It doesn’t include any brokerage nor does it factor in the fact that we have trades in different currencies. Holdings in different currencies need to be converted to a base currency before an accurate gain can be calculated. Stock Portfolio Organizer does both with ease and even allows you to create brokerage and currency conversion formulas.

Yahoo Finance doesn’t allow you to record income in the form of dividends and trust distributions. So if you own any trusts or dividend generating stocks you will need to maintain a separate excel spreadsheet to track that income. Stock Portfolio Organizer can do that and even calculate interesting metrics such as the average return on investment – that is the average return that your investments in trusts and dividend generating stocks have returned in the form of income.

3. Stock Portfolio Organizer allows you to track complex instruments such as Forex (FX), CFD’s, Futures etc.

Yahoo Finance only lets you track the simple return for share trades. If you trade more complex instruments such as Forex (FX), CFD’s, Futures etc you are out of luck. Stock Portfolio Organizer supports all these and more.

4. Stock Portfolio Organizer lets you chart your portfolio’s performance

Yahoo finance does not allow you to chart the performance of your portfolio. Stock Portfolio Organizer, on the other hand, allows you to chart the performance of your portfolio and also allows you to apply various filters to the trades. It also allows you to chart more than one performance curve so you can make comparisons between different groups of trades. For example, if you want to compare the performance of your investments in mining stocks against health stocks you can do that.

Conclusion

There are many more examples of the extra features and capabilities that Stock Portfolio Organizer has. You can check them out for yourself by trying the trial version here.

Another noteworthy feature of Stock Portfolio Organizer is that it’s a desktop application. Data is stored on your computer, so it is secure and you will never lose access to it. Just recently in 2017 Google shut down its portfolio tracking feature, who is to say that it can’t happen to other portfolio managing systems.