The following guide shows the steps to record a Australian dividend income. The same steps can be used for adding dividends for non Australian markets and trust distributions.

For residents outside Australia click ‘Enter Dividend’ instead of ‘Enter Australian Dividend’.

Step 1: Open 'Australian Dividends' window

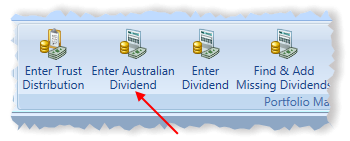

To add a new dividend click the ‘Enter Australian Dividend’ toolbar item located in the main menu.

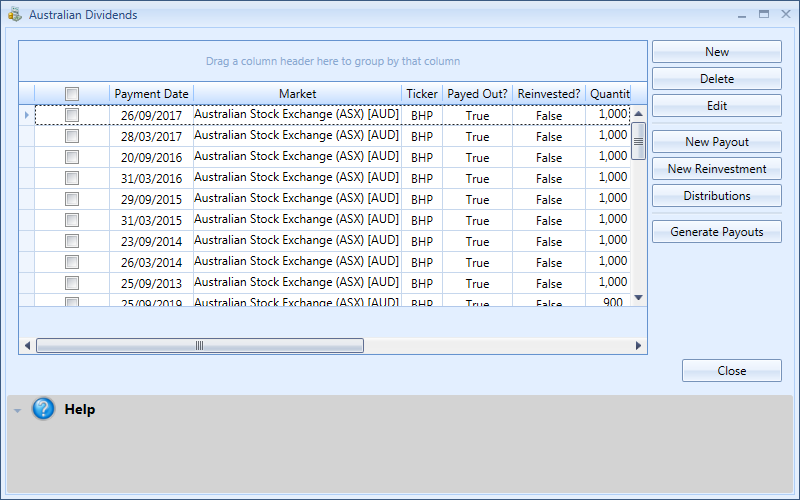

This should open a window similar to the following.

Step 2: Open 'New Dividend' window and enter details

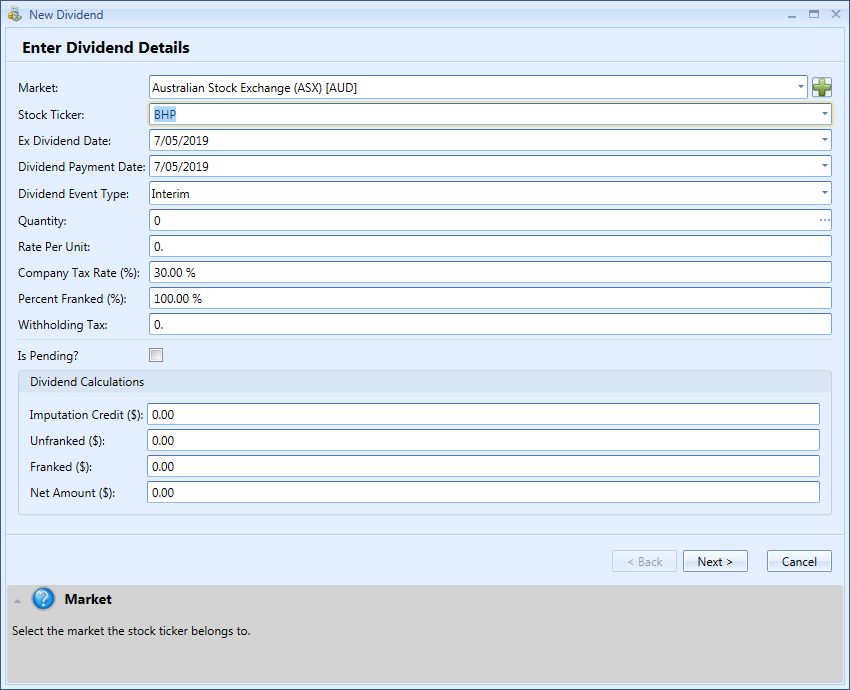

To add a new dividend click on the ‘New’ button in the ‘Dividends’ window (shown above). This should open a window similar to the one below.

Stock Ticker – The ticker the dividend is for.

Ex Dividend Date – The ex dividend date occurs one business day before the company’s Record Date. To be entitled to a dividend a shareholder must have purchased the shares before the ex dividend date. If you purchase shares on or after that date, the previous owner of the shares (and not you) is entitled to the dividend.

Dividend Payment Date – The payment date is the date on which a company’s dividend is paid to shareholders.

Quantity – Dividend quantity. If you have filled in the ticker and ex dividend date, you can use the button with the three dots next to the field to automatically calculate the dividend quantity.

Dividend Rate – Dividend rate.

Company Tax Rate (%) – Company tax rate.

Percent Franked (%) – Percentage of the dividend that is franked. A franked dividend is an arrangement in Australia that eliminates the double taxation of dividends. You can leave this field as zero if not applicable.

LIC Capital Gain – LIC capital gain amounts.

Step 3: Assign dividend quantity to trades

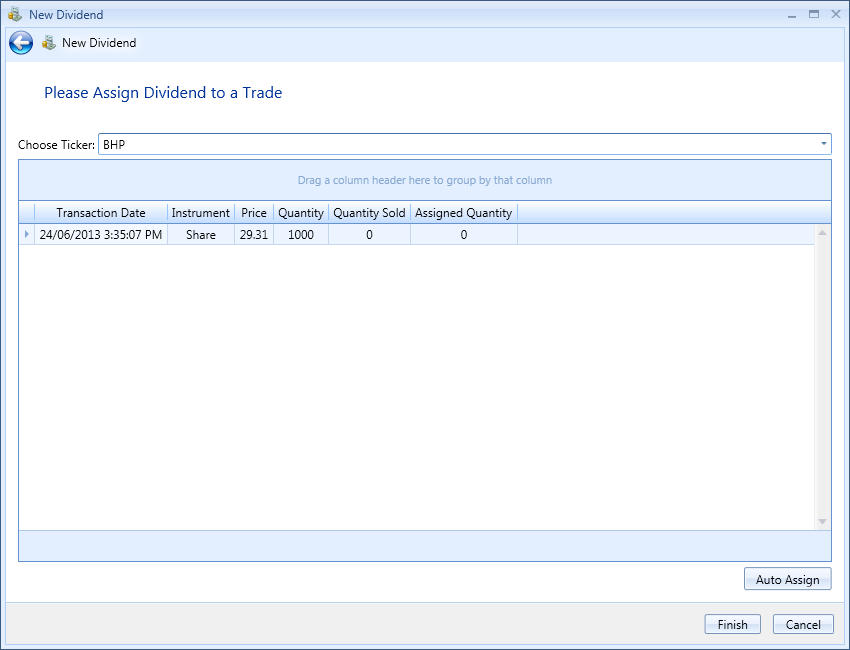

Once you have filled in all the details click ‘Next’ to continue. Assigning the dividend quantity to each trade is an optional step. It is used for calculating the average yield on cost and the profit/loss of a trade with income etc. If you are entering a trust distribution, it is also used to reduce the cost base by the tax deferred amount. It is highly recommended you complete this step otherwise you will miss out on useful metrics that Stock Portfolio Organizer can calculate using this information.

Choose Ticker – Normally you don’t need to touch this field but, in the rare case where you forget to add a dividend and the stock later experiences an event that changes its symbol name, you can still locate the trade this dividend belongs to by choosing the ticker for that trade.

You can use ‘Auto Assign’ to automatically allocate the dividend quantity belonging to each trade or you can manually enter each value in the corresponding grid cell. Normally, if you enter your dividends and trades in order, the ‘Auto Assign’ button should make the correct assignments. Click ‘Finish’ when you are done to save the dividend.