One of the most important things when trading is money management. A good portfolio manager should not only help you track your trades but also help you with position sizing and risk management. Stock Portfolio Organizer is able to do both.

Position sizing can be accomplished via ‘Instrument Formulas’ which have access to account and trade information and can be displayed in the trade entry windows. If you are not very good at programming, that’s okay as there are some formulas already included. If none of the formulas meet your needs, don’t hesitate to contact us.

When entering a trade, you can specify the target or stop loss for the trade. You can also create alerts to let you know when a trade has hit its target or stop loss.

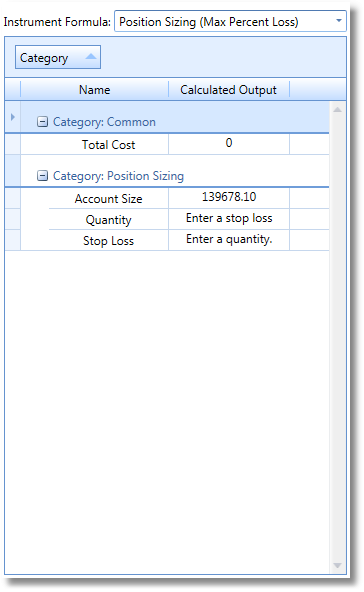

The screen shot on the left is a portion of the share entry window with a simple position sizing formula selected which can calculate the quantity or stop loss based on maximum percent risk per trade specified via parameters. So, how does it work? First, you need to select an account and trade group. This allows the formula to calculate your account balance and work out how much money you have invested. Now, let’s say you want to purchase MSFT shares for $69 and have worked out that if the price dips below $65 you would like to get out. You would enter $69 for the price and $65 as the stop loss. The formula should then calculate the quantity you need to purchase (let’s say it is 116 for the sake of this example). You can then save this trade as pending and try to purchase 116 MSFT shares at $69.

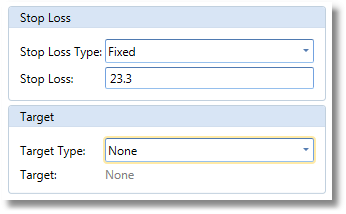

The following is a screenshot of the ‘Risk’ tab in the trade entry window. It allows you to set the stop loss or target for the trade. Currently a fixed price and percentage type is supported.

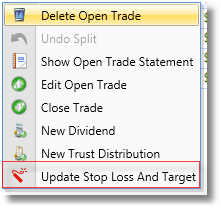

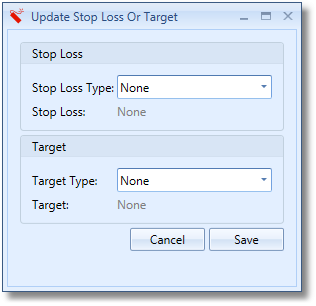

Markets change all the time so, being able to update the target or stop loss quickly after a trade has been added, is important. Stock Portfolio Organizer allows you to quickly update the stop loss or target in the ‘Currently Open Trades’ view at any time by right clicking a trade and selecting ‘Update Stop Loss & Target’.

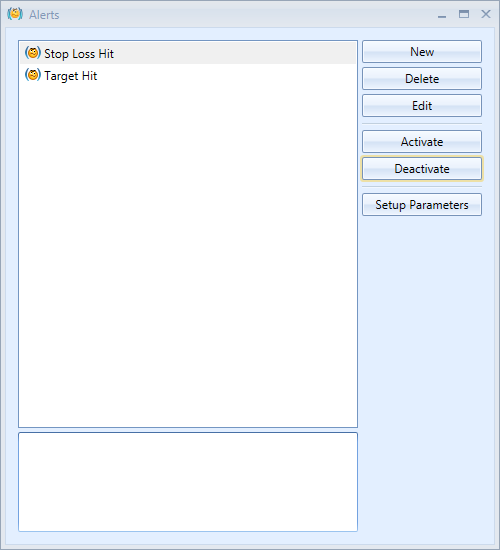

By using alert formulas you can be notified when one of your stop losses or targets has been reached. You can activate stop loss and target alerts via the ‘Alerts’ window. The following is a screenshot of the ‘Alerts’ window.