CFDs have become a popular investment product in recent years for many reasons. They allow you to speculate on the price movement of a whole host of financial markets such as indices, shares, currencies, commodities and bonds, regardless of whether prices are rising or falling. How do you enter CFD trades into Stock Portfolio Organizer so they can be tracked/managed? The following is a guide on how to enter share, index, forex and commodity CFDs.

Share CFDs

Share CFD’s are simple. You will need the professional version of the program. Let’s take a look at an example:

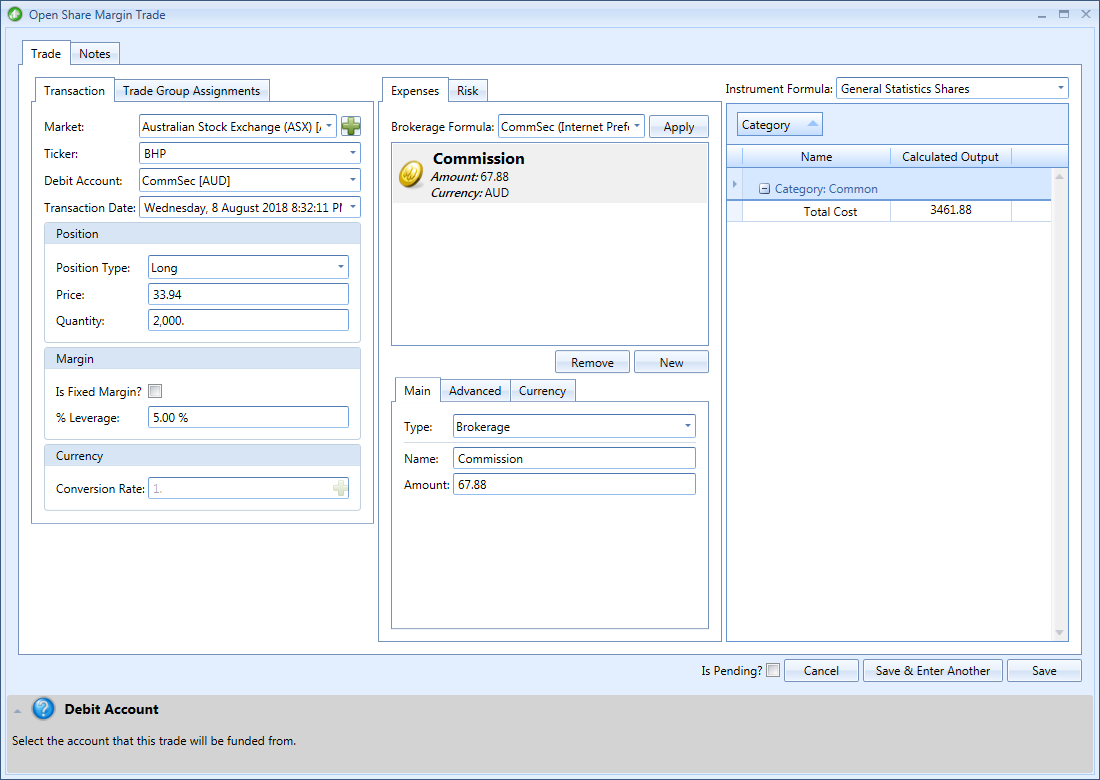

Let’s say you bought 2000 shares as a CFD (opening your position) at $33.94 of BHP, which means that you pay an initial margin of $3,394 (5% of $67,880). If the broker charges 0.10% commission on the transaction, you pay $67.88 commission.

To enter this trade click the ‘Enter Trade’ button (found in the main toolbar). A window should appear asking you to select the instrument type. Select ‘Share Margin’ then click ‘OK’. The ‘Open Share Margin Trade’ window should appear. Enter the above trade as follows:

Once done click ‘Save’

Index & Commodity CFDs

You enter index and commodity CFD trades much like normal futures trades with a couple of differences. Firstly, futures tend to be traded on the big exchanges and usually will come with large minimum commitments from market participants as the contracts are designed for use by investment banks and other city institutions. CFDs, on the other hand, usually have no minimum commitments. Secondly, many CFD prices are computed from the underlying futures market price then adjusted to suit the broker, effectively adding a layer of distortion. For these two reasons it is recommended that you create a separate market for each broker you trade CFDs with and create futures tickers in these markets with the correct symbol, tick size and tick value. For example:

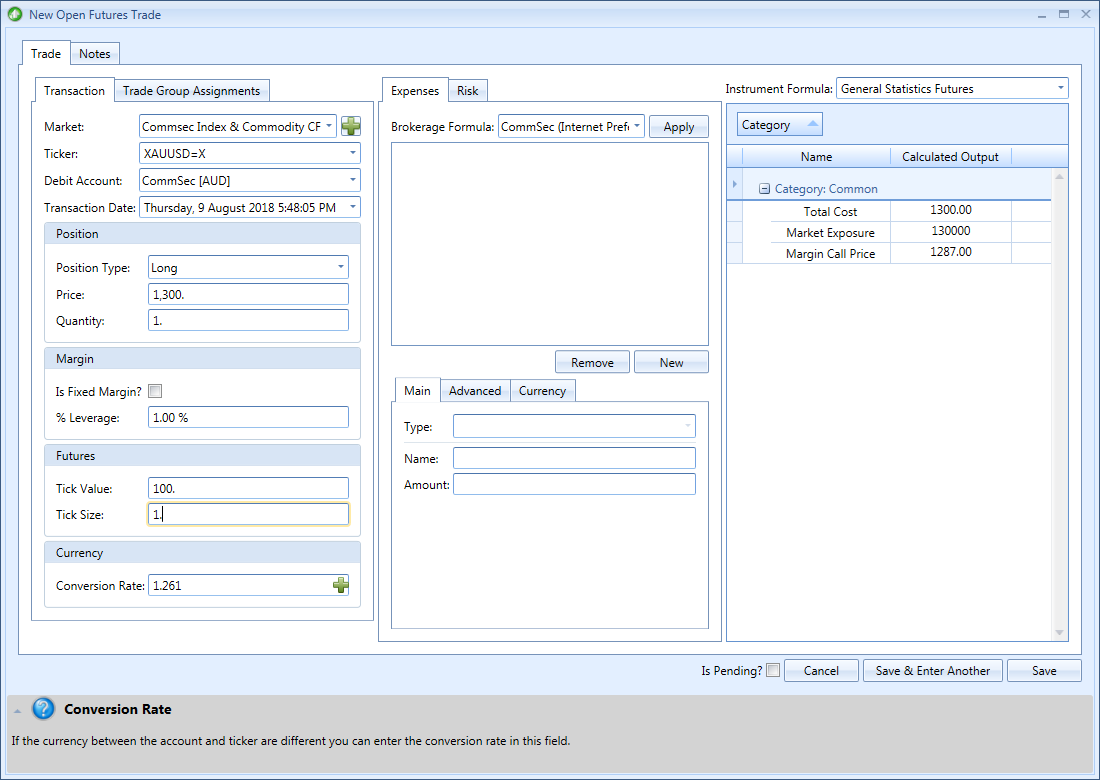

Let’s say you bought 1 lot as a CFD (opening your position) at $1300 of Gold, which means that you pay an initial margin of $1,300 (1% of $130000).

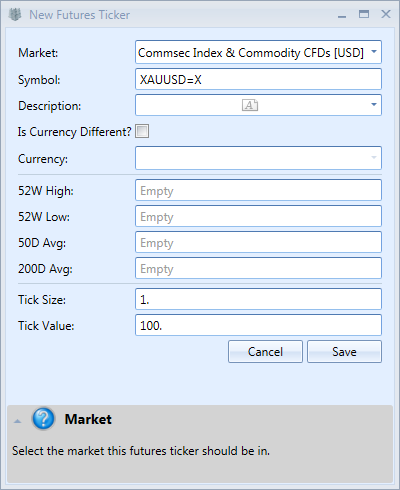

If our CFD broker was Commsec for this trade, we should create a new ‘Ordinary’ market called ‘Commsec Index & Commodity CFDs’. Since most of the commodity and index CFDs with Commsec are traded in US Dollars, choose that as the currency for this new market. Next, you can add a futures ticker for Gold to this market now or later when entering the trade. For this article we will do it now. So, open the ‘Tickers’ window then click ‘New’. In the ‘Select Ticker Type’ window choose ‘Futures’ then click ‘OK’. In the ‘New Futures Ticker’ window fill in the details as shown in the screenshot below.

Notice that the symbol we have chosen for gold is ‘XAUUSD=X’ since we are using free yahoo data and that is the symbol for the spot price of gold in US Dollars. The ‘Tick Size’ is 1 and ‘Tick Value’ is 100 which means that for each dollar move in the spot price of gold we stand to make or lose $100. Now we can enter the trade. Click ‘Enter Trade’ button (found in the main toolbar). A window should appear asking you to select the instrument type. Select ‘Futures’ then click ‘OK’. The ‘Open Futures Trade’ window should appear. Enter the above trade as follows:

Once done click ‘Save’

Forex CFDs

Entering a Forex CFD trade is no different to entering a normal forex trade except that the Lot Size will most likely be smaller. To enter a forex trade click ‘Enter Trade’ button (found in the main toolbar). A window should appear asking you to select the instrument type. Select ‘Forex’ then click ‘OK’. The ‘Open Forex Trade’ window should appear where you can enter your trade.