By Paul Maplesden

Investing in stocks can be a great way to build up your investments over time, and a healthy portfolio can provide a decent residual income. Before you part with any money, it’s important to understand what you’re getting into so that you don’t feel overwhelmed. Here are some practical hints, tips and advice on what you can do and what to expect when you’re investing in the stock market.

Never invest more than you can afford to lose. Although over the long term, the stock market outperforms almost every other type of investment, that’s not a guarantee that every stock is going to make money. That’s why the golden rule is ‘Never invest more than you can afford to lose’. You should only invest in the stock market with disposable income after you have paid all of your necessary bills and have short-term savings.

Learn common stock market terminology

You should research some of the more common terminology used in the stock market and information that refers to a company’s financial performance. This could include areas such as: Price/Earnings (P/E) Ratio, Market Capitalization, Sales, Turnover, Profits, Dividends and more. It’s also very helpful if you learn to read company financial reports as they will give you additional insight into a business.

Get an overview of how the stock market works

It’s important to understand how the stock market works as a whole. Spend a little time learning about how stocks are bought and sold and what the various measures in the stock market mean (e.g. Dow Jones, FTSE, S&P 500, Nasdaq).

Understand the business that you are buying stocks in

You should understand how the business that you are buying into makes its money. Spend some time researching their business model, financial reports and plans for growth. Satisfy yourself that you know the business well enough to invest some of your money with them.

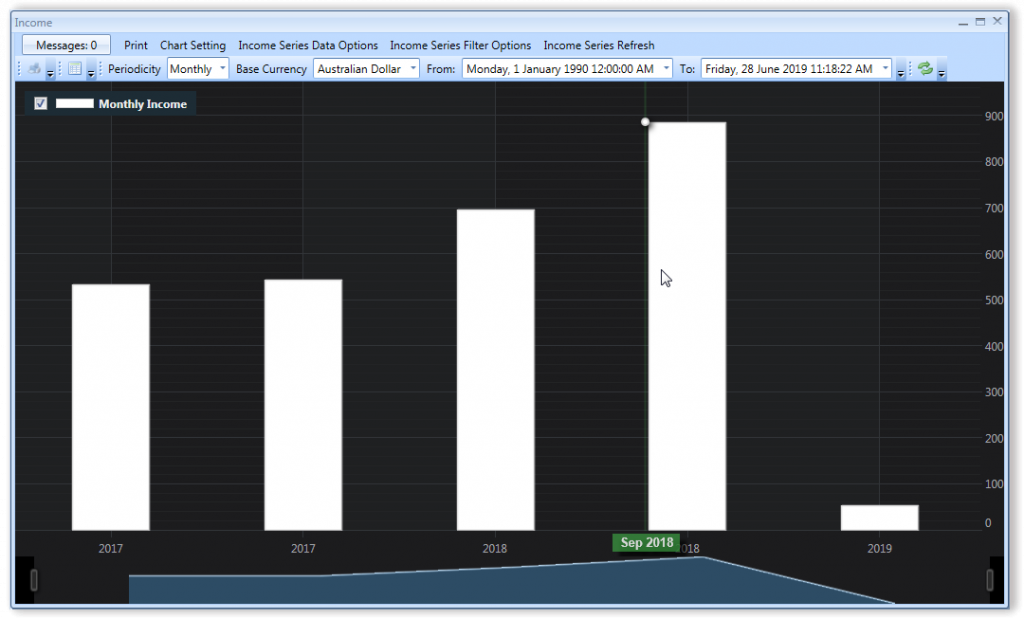

Look at a company’s historical performance

Even though it’s not a guarantee that a business will do well in future, you should look at the last few years of financial reports for a company that you’re thinking of investing in. If they have solid finances and don’t seem to take unnecessary risks, that should increase your confidence of investing with them.

Find an online broker that has good rates

Commission charges and fees for trading will all eat into your profits and returns. Spend some time reviewing and comparing the various online brokers like Scottrade, E-Trade, Motley Fool and the like.

Start by investing small amounts

To begin with, don’t invest large amounts of money in your portfolio or in any one particular company. You can start by investing comparatively small amounts in individual businesses and tracking how each of them is doing. This also means that you won’t lose as much if one of the businesses runs into trouble.

Diversify your risks with a broad portfolio

The wider the range of companies that you invest in, the greater your chance of minimizing your risks and losses. If you have the time to investigate individual businesses, buy stocks across a range of sectors and industries, and in businesses of various sizes.

Hold stocks for the medium to long-term

Most personal investors make their money from the stock market over the medium to long-term (from five years up to 50 or more years.) When you buy a stock you should do so with the intent of holding it for at least five years, and preferably longer.

Don’t buy ‘boiler room’ or penny stocks

Avoid ‘boiler room’ and penny stocks at all costs. Boiler room stocks are generally offered by call centers cold-calling people and using high-pressure sales tactics to try and persuade them to invest. These type of stocks typically devalue very quickly and you are very likely to lose money. Likewise, penny stocks (where the price per stock is typically a few cents or less) are extremely risky investments. When a company’s stocks are trading at such a low value, it’s often a sign that things are not working out well for the business.

Don’t be too concerned about short-term gains and losses

Even if your investment makes or loses money in the short-term, don’t be overly concerned. Because you should be holding stock for at least a few years, there’s a very good chance that short-term trends will correct themselves and that the value of your investment will grow over time.

Don’t day-trade

Day-trading, the practice of buying and selling large numbers of stocks over a short time period, is best left to the professionals. Day-trading is extremely risky and can result in you losing money very quickly.

If you don’t have time to research, consider a stock market tracker

If you want to invest but don’t have lots of time, knowledge or expertise, you might want to consider a stock market tracker, also known as an index tracker. These funds track the movement of the stock market as a whole and let you invest in its overall performance. They have several advantages:

- Index trackers are inexpensive to set up and have very low ongoing fees.

- Your risk is low, compared to investing in individual businesses. Because you’re tracking and investing in the overall market, changes in the price of one stock won’t cause too much of an impact.

- You can easily make ongoing payments into your tracker fund, building up your investment over time.

- You don’t need very much money to get started

- Most of the time (around 80%), you’ll get a better return tracking the market as a whole than from an individual stock

In closing

If you’re interested in your long-term financial future and have the patience to hold your investments for at least five years, investing money in the stock market can be a great way to build your wealth. Spend some time learning the basics of the markets, researching businesses and making sensible choices and you’ll have an excellent chance of prospering.